Apartment Fundamental Outlook Improved As Supply Wanes

Marcus Lindstrom

One apartment REIT after another beat on 1Q24 earnings which was surprising as the sector is undergoing a massive new supply wave with development deliveries as much as 5% of existing inventory hitting the sector in 2024 and the first half of 2025.

So how has the sector been able to absorb the new supply so well?

In examining the data, it seems there is a perfect storm of demand drivers:

- Strong employment

- Low savings rate

- High cost of houses

- High cost of construction

- Mortgage rates

These factors sum to high household formation and low affordability of alternatives which has kept existing renters in apartments and caused newly formed households to choose apartments.

This article will examine the better than anticipated fundamentals of the sector and discuss which REITs might present the best investment opportunities.

The supply wave (magnitude and timing)

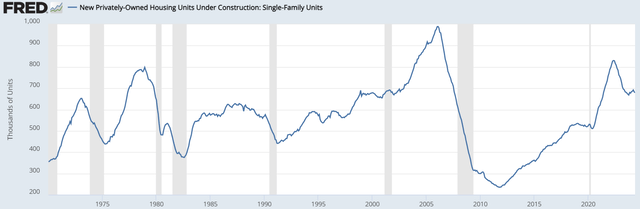

2022 featured macro forces which facilitated a bit of a construction boom. Profitability of real estate was very high and cost of capital was cheap as interest rates were quite low. With these factors, developments penciled nicely and seemingly a large number of developers laid out plans.

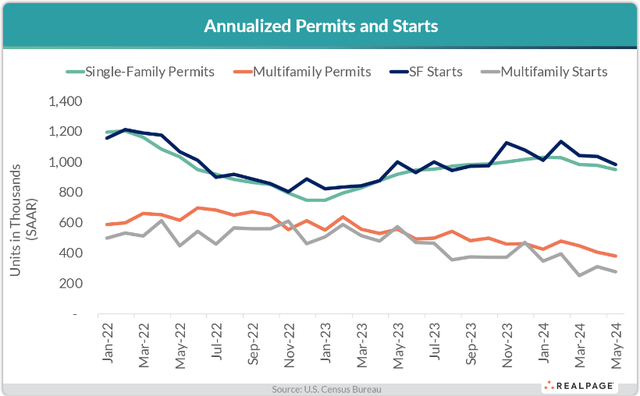

- Single family permits and starts approached 1.2 million units in early 2022

- Multifamily permits exceeded 600,000 units and starts exceeded 500,000 units.

This kicked off the supply wave which sent multifamily REIT prices tumbling. In early 2022 apartment REIT prices hit all-time highs as the market was still enjoying the roughly 15% rent growth the sector experienced in 2021/2022. However, as time went on, it became clear that incoming supply was going to be an issue and the sector sold off, down nearly 40% from its highs.

S&P Global Market Intelligence

Building an apartment complex takes time so there is a roughly 1-to-3-year delay depending on a variety of factors from when a development starts to when it gets delivered.

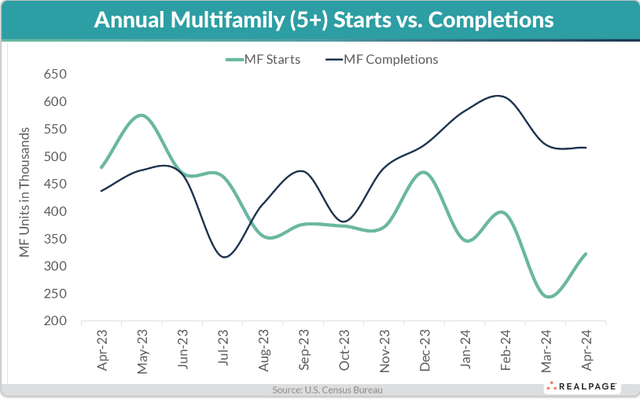

That construction boom of 2022 is hitting primarily in 2024 and early 2025. Note on the chart below how multifamily construction starts have dropped to low levels, but the completions are still at very high levels.

Thus, there will be a wave of supply hitting in the near term, but supply beyond 2025 looks quite muted.

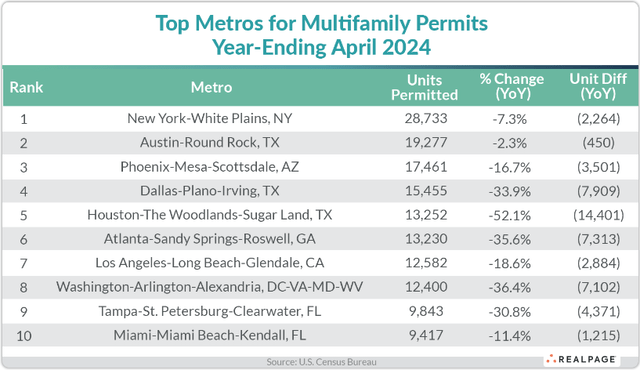

This seems to hold true across all MSAs with supply dropping off hardest in those which had the most. Houston, for example, is presently an epicenter of deliveries, but new permits have dropped by 52% as of April 2024.

So in summary of the supply outlook:

- High deliveries now through mid 2025

- Low deliveries after 2025

As new apartments are delivered, there is often promotional pricing to attract occupants which can make it difficult for nearby existing apartments to maintain rent.

Thus, the REITs are currently facing a difficult period in which rental rates and occupancy are both threatened. How well they survive this rough patch will depend on the extent to which incremental demand offsets the incremental supply. 500,000 units being delivered is not so scary if there are also 500,000 units of net absorption.

Demand drivers running hot

Newly formed households usually start in apartments while they are saving up money to buy a home. Thus, the aggregate demand for apartments is related to both new household formation and attrition as renters are lost to becoming homeowners. It of course can go the other way in which homeowners become renters, but this is less common.

Household formation is driven by household income. With employment remaining quite strong, household formation has been strong.

At the same time attrition to homeownership is particularly weak due to the following factors:

- Houses are particularly expensive (absolute dollar price of purchase)

- Mortgages are expensive

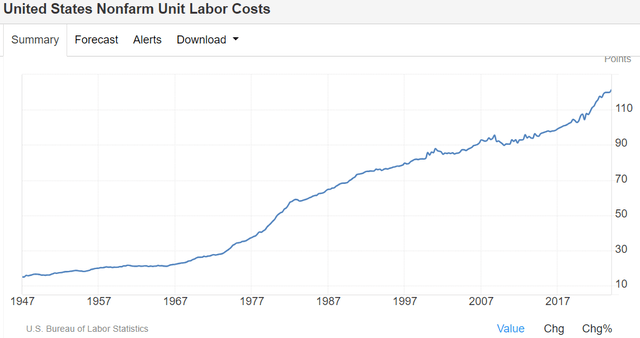

- Building new houses is expensive (labor and financing)

- Household savings are meager making down payments difficult

- Apartments are more affordable than owning relative to normal

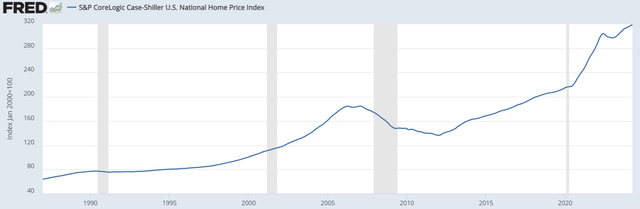

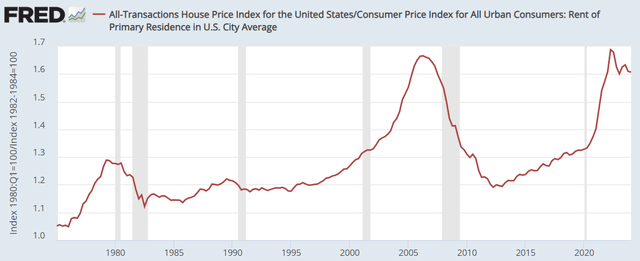

The Case Shiller index tracks the prices of homes. It has reached an all-time high.

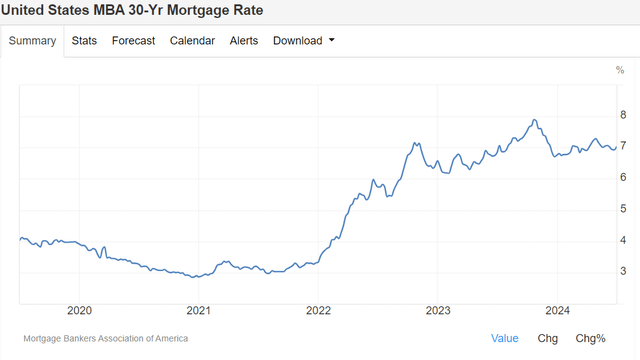

These high prices are made even more difficult by mortgage rates being over 7%.

Thus, a home buyer not only has to pay more for the home, but has to pay more interest on the portion that they borrow. High home values also increase property taxes.

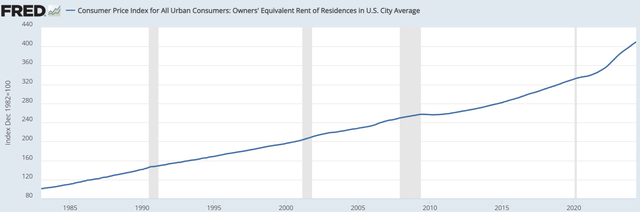

The combination of mortgage payments, sticker price and taxes forms owners’ equivalent rent which is also at an all-time high indicating home ownership is the most expensive it has ever been.

An alternative to buying an existing home is to have a new home built. One factor working in favor of new home construction is a relatively low cost of lumber.

Single family homes are a higher percentage lumber than apartment communities so cheap lumber works relatively in favor of home affordability.

However, homebuilding remains quite expensive due to labor and financing which are larger portions of the overall cost budget.

Homebuilders are attempting to woo buyers by paying down mortgage rates such that the buyer can functionally get lower monthly payments. It is working with most of the homebuilders remaining quite profitable even through the unfavorable interest rate environment, but unfortunately the profit margins primarily exist in higher priced homes with very few cheap homes being built. Overall, single family home construction has fallen significantly since interest rates started spiking in 2022.

All of these challenges for home ownership sum to renting being more affordable than owning. In fact, the relative affordability of renting is much better than normal with the only time in which home ownership was so relatively expensive was the housing bubble of 2005-2007.

The above chart measures the indexed cost of buying a home relative to renting an apartment.

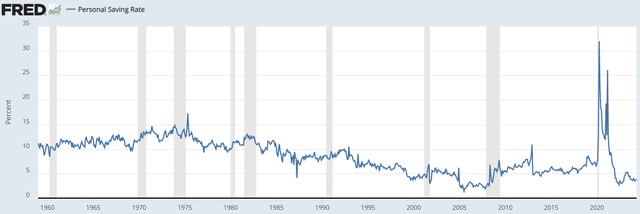

Finally, and I think this is perhaps the biggest factor, personal savings rate is dangerously low.

People simply aren’t saving their money anymore. Without savings, down payments are insurmountable which is forcing people to rent instead of own.

Low savings rate is a longer acting factor than the others. Home affordability can correct quickly if house prices decline or if mortgage rates come back down, but it takes many years to save up enough money for a house and if people aren’t saving they won’t be able to afford a home even if homes get cheaper.

Given the paucity of personal savings, I think apartment demand will remain elevated for an extended duration.

Demand keeping up with supply and demand will last longer

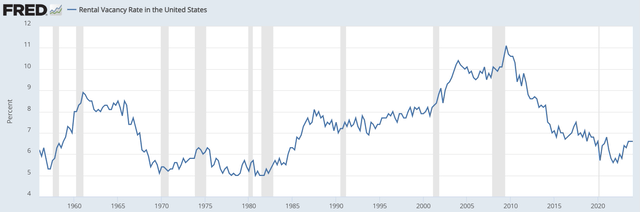

Due to all of the above factors, net absorption of apartment units has been quite strong such that despite the supply wave occupancy has remained healthy.

Apartment vacancy rate as of 1Q24 was 6.6% which is relatively low historically speaking.

This demand is essentially causing a soft landing in which rents have stayed basically flat in the face of the wave of deliveries. However, the demand drivers are likely to outlast the new supply.

Supply growth is dropping in mid-to-late 2025 while it could take much longer for home affordability and personal savings to normalize.

As such, I think apartments will be well positioned to grow rents and attain 95%+ occupancy starting in late 2025. This makes investment in the sector rather appealing, particularly compared to the previous consensus which was calling for oversupply.

Valuation and opportunities

Bearishness from supply has resulted in the sector trading at rather cheap multiples.

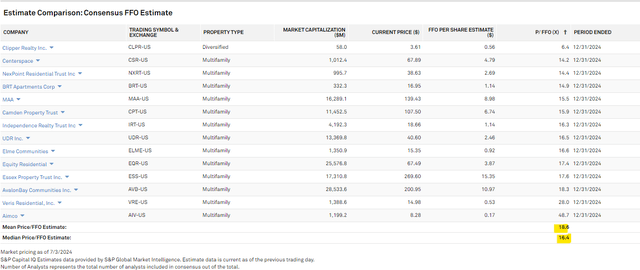

Nominally the mean P/FFO is 18.6, but that is skewed by Aimco (AIV) and Veris (VRE) which have company specific factors making their valuations wonky.

S&P Global Market Intelligence

The rest can be bought for fairly low multiples with a variety of high quality REITs in the 14X-16X range.

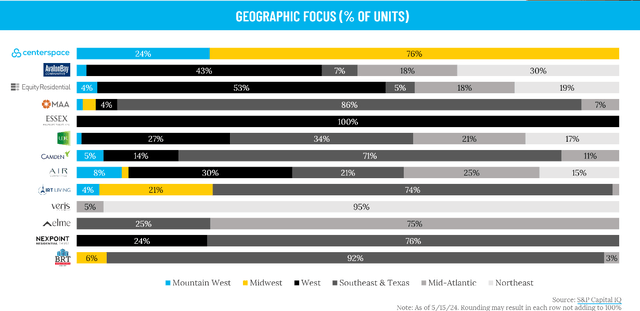

I think fundamental performance will vary significantly by location of properties. Below is the geographical positioning of each REIT.

The West Coast has weak demand due to domestic migration trends suggesting people are leaving the West for the South.

Oddly enough, the West Coast apartment REITs are trading among the highest multiples in the sector so I think those would be a mistake to buy here.

Midwest fundamentals are interesting. The Midwest has moderate demand growth, but it also has not had anywhere near as much supply as the sunbelt making midwestern markets among the best performing in the near term. Without as much supply to contend with, many of the midwestern markets have actually been able to grow rent even in 2024. Centerspace (CSR) is the only publicly traded REIT focused on the Midwest and it looks somewhat opportunistic. I worry a bit about some aspects of Minneapolis multifamily, but some of their other markets like Omaha look fantastic.

The sunbelt is the epicenter of both supply growth and demand. I anticipate sunbelt REITs like Camden (CPT) and NexPoint (NXRT) to have some difficulty in 2024 and early 2025 due to the magnitude of supply in their particular submarkets, but data coming in suggests it is being well absorbed by the sheer number of jobs and population moving to these areas.

I think 2024 will come in flattish and then both CPT and NXRT are well positioned for the long run.

The bottom line

Heavy new supply is a short term risk factor for apartments while demand drivers appear to be longer lasting. Frankly, renting is just more affordable than homeownership right now and that will likely remain the case until rental rates go up significantly.