Endeavour Silver: Limited Margin Of Safety At Current Levels (TSX:EDR:CA)

Evgeny Gromov

While most precious metals names reported margin expansion in Q1 2024 on the back of stronger metals prices, Endeavour Silver Corp. (NYSE:EXK) was an exception, battling a stronger Peso and lapping difficult comps at its Guanacevi Mine from a grade standpoint. The result was that AISC margins sunk to below 10% in Q1 2024 and the company generated limited cash flow despite the stronger gold price. On a positive note, Q2 is shaping up to be a much better quarter, benefiting from a further boost from gold by-product credits and a much stronger silver price. In addition, its Terronera Project is nearing the finish line, a transformative asset that will help to improve EXK’s company-wide margin profile.

In this update we’ll dig into the recent results, the Q2 outlook, and whether EXK still offers value at current levels.

Endeavour Silver Q1 Production & Sales

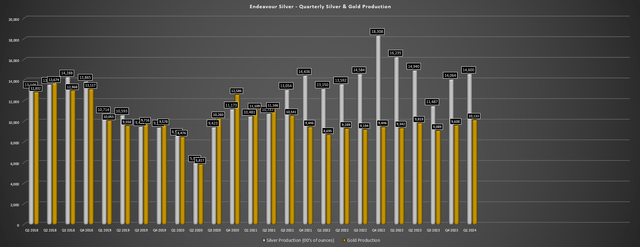

Endeavour Silver released its Q1 production results, reporting quarterly production of ~1.46 million ounces of silver and ~10,100 ounces of gold. This represented a 10% decline in silver production year-over-year, offset by a 9% increase in gold production. The lower silver production was attributed to significantly lower grades at Guanacevi (402 G/T of silver vs. 511 G/T of silver), as well as lower grades at Bolanitos (42 G/T silver vs. 61 G/T of silver). Fortunately, higher gold grades at Bolanitos more than offset the lower silver grades, which, combined with higher gold prices, resulted in a much better quarter from this smaller asset.

Endeavour Silver Quarterly Gold/Silver Production – Company Filings, Author’s Chart

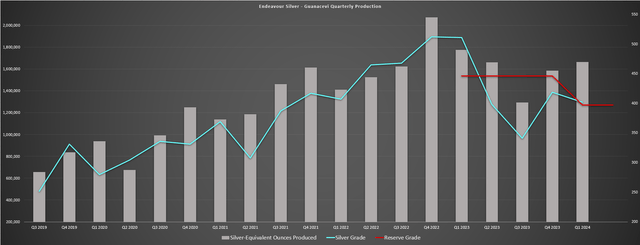

Digging into the results a little closer, Guanacevi produced ~1.34 million ounces of silver and ~4,100 ounces of gold, down from ~1.42 million ounces and ~4,200 ounces, respectively. Higher mill throughput of ~115,000 tonnes and higher recoveries were more than offset by the 21% lower silver grades. Endeavour noted that the lower grades were consistent with the mine plan and the sharp dip and production declines at Guanacevi shouldn’t be surprising given that the company was mining well above reserve grades in 2022 through early 2023 (shown below). Based on lower production, a stronger Peso, and continued inflationary pressures, AISC spiked to $21.96/oz, a 14% increase year-over-year.

Guanacevi Mine Quarterly Production – Company Filings, Author’s Chart

Fortunately, while Guanacevi had a softer Q1 with higher production at lower margins, Bolanitos had a better quarter from a margin standpoint. This was despite lower year-over-year production of ~124,300 ounces of silver (Q1 2023: ~183,600 ounces), offset by 17% higher gold production. The result of the higher gold by-product credits (increased gold ounces sold at higher prices) led to mine site AISC declining to $15.59/oz vs. $27.45/oz in the year-ago period, a 43% decline. The good news is that this tailwind for costs should continue into Q2 with the gold price expected to be up 12% sequentially (Q2 vs. Q1) to ~$2,330/oz or better.

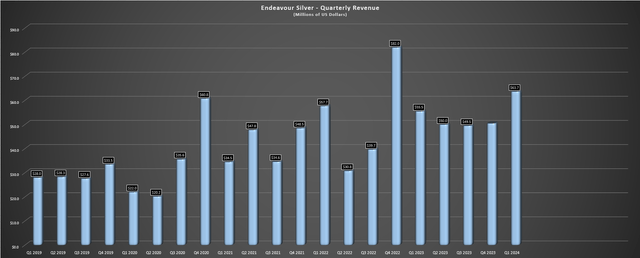

Endeavour Silver Quarterly Revenue – Company Filings, Author’s Chart

As for the company’s financial results, Endeavour reported revenue of $63.7 million (+15% year-over-year), $4.6 million in operating cash flow (Q1 2023: [-] $0.4 million), and a free cash outflow of $40.3 million (Q1 2023: free cash outflow of $21.1 million). This was related to higher spending at Terronera which saw capex nearly double year-over-year to $40.3 million. As for Endeavour’s balance sheet, the company ended the quarter with cash & cash equivalents of $34.9 million and ~$28 million in net cash. However, this was largely related to significant share sales, evidenced by ~23.1 million shares being sold under its ATM in Q1 alone at US$1.72, resulting in ~11% share dilution at multi-year lows, a painful level of dilution for an established and producing company.

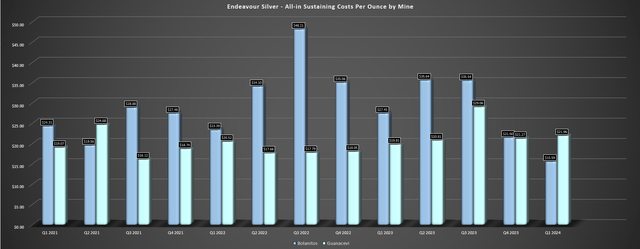

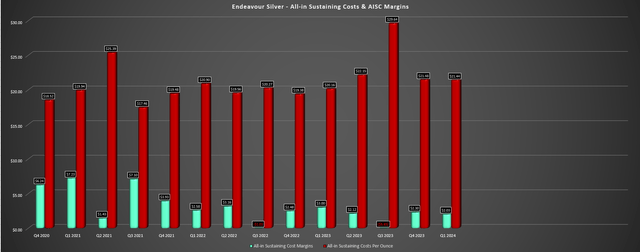

Costs & Margins

Looking at costs and margins, Endeavour’s Q1 AISC of $21.44/oz, up 6% year-over-year, but below budget because of the benefit of higher gold by-product credits and lower sustaining capital spend ($7.0 million vs. $8.0 million). Endeavour called out higher power, labor, and consumables costs being headwinds from a cost standpoint, and the stronger Mexican Peso certainly didn’t help. Given the limited increase in the silver price year-over-year ($23.47/oz vs. $23.16/oz), AISC margins sunk to $2.03/oz vs. $3.00/oz in the year-ago period. And while its higher-cost current operations will be diluted by lower-cost Terronera ounces, the sticky inflationary pressures suggest Terronera operating cost estimates are too low, with a more realistic AISC of ~$12.00/oz on silver-equivalent ounces vs. the $9.84/oz reported in the 2023 FS update.

Endeavour Silver – Quarterly Costs by Mine – Company FIlings, Author’s Chart Endeavour Silver AISC & AISC Margins – Company Filings, Author’s Chart

While these are still very solid margins at Terronera and will help to pull down Endeavour Silver’s costs materially starting in H2 2025, it is a downgrade from my previous outlook. So, while Terronera is undoubtedly an upgrade for the investment thesis, it’s not as significant as I initially expected given the cost creep across all operations. Endeavour Silver had the following to say on its Q1 2024 Conference Call:

“We haven’t provided guidance from an operational standpoint for Terronera since April 2023 when we announced the construction decision. And at that time, we put out an optimized plan and highlighted an ~$81 cost/tonne. And that cost per tonne had come down from the FS of ~$87 to ~$81 because of the economies of scale. That estimate was done effectively in December of 2022, and January of 2023.

Since the start of 2023, across the industry and specifically in Mexico, you’ve had the appreciation of the Mexican Peso by 15%. You’ve had inflationary pressures, specifically on steel, reagent, and power costs, all in Mexico. So it would be very fair to assume that you’ve had escalations from an operating standpoint at Terronera going from $81 maybe you get into the $95 or $100 range. As we go into production, hopefully later this year, like I say, commissioning for Q4, management will update those costs.”

– Endeavour Silver Q1 2024 Conference Call

So, what’s the good news?

While Endeavour Silver reported razor-thin margins in Q1 2024, the company should see significant margin expansion in the upcoming quarter with the silver price averaging over $28.50/oz quarter-to-date and the gold price averaging above $23.00/oz. Not only will this give it a boost from a by-product credit standpoint at Bolanitos to pull AISC down further from Q1 2024 levels, but the company will enjoy a higher selling price in the upcoming quarter as well. Hence, it wouldn’t shock me to see Endeavour Silver report AISC margins of $6.00/oz or better in Q2 2024 (Q2 2023: $2.12/oz), and we should see a very strong Q3 as well with the Mexican Peso looking to have finally topped out vs. the US Dollar (UUP).

Recent Developments

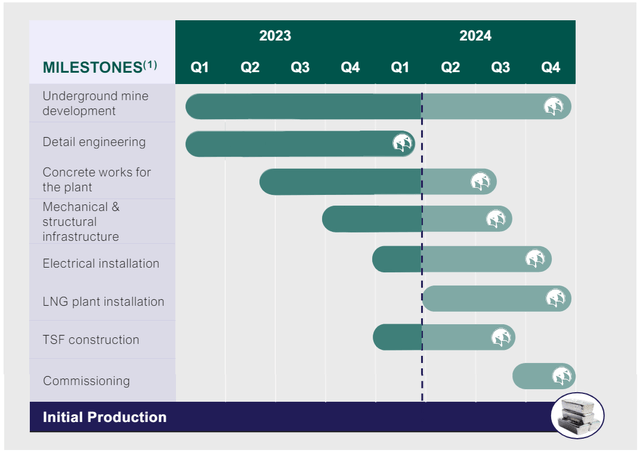

Moving to recent developments, Terronera has passed the halfway mark for construction and remains on track for its first production by year-end 2024. Since the start of construction, the company has spent ~$158 million or ~58% of its updated capital estimate of ~$271 million, with a more conservative figure being $280 million to bake in any minor cost overruns vs. the previous estimate. This leaves ~$120 million left to spend on construction with this available to Endeavour from ongoing cash flow from operations, its undrawn $120 million debt facility ($60 million drawn in April after the end of Q1), and its current cash position. Hence, while we have seen massive increases to the Terronera capex bill from ~$175 million previously in 2021, the project does look fully funded.

Terronera Project Construction – Endeavour Silver

As for the most recent progress update, Endeavour noted that 83% or ~$225 million had been committed, and over 3,200 meters of underground development had been completed. As for surface activities, surface mill and infrastructure construction was 56% complete while concrete work and structural steel erection stood at 83% and 80% complete, respectively. During Q2, Endeavour will mine the first development ore based on the current schedule, with long-hole mining expected in Q3 followed by cut and fill mining to prepare an ore stockpile for ramp-up. Overall, things appear to be progressing quite smoothly which is positive to see, and the current timeline suggests we could see roughly three full quarters at full production levels in 2025 for Terronera, assuming commercial production is reached by late March/early April.

Terronera Construction Timeline – Company Website

So, what are the benefits of Terronera?

As outlined in past updates, this project is capable of producing ~7.0 million silver-equivalent ounces per annum at much lower costs (~$12.00/oz AISC?) which will help to improve Endeavour’s margins. This is important because the company currently has razor-thin margins but Terronera will morph it into an average-cost producer vs. one of the highest-cost producers sector-wide. Overall, this would have helped with a significant re-rating in the stock, but with EXK already up over ~160% off its lows in the same period that we saw over 20% share dilution (effectively a 200% increase in its market cap), I’m not sure how much room is left for a re-rating here near-term.

Valuation

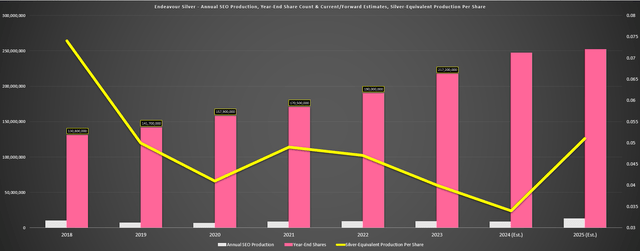

Based on ~248 million fully diluted shares and a share price of US$3.60, Endeavour Silver trades at a market cap of ~$890 million and an enterprise value of ~$920 million when factoring in debt recently drawn on its debt facility. This leaves Endeavour Silver trading at over P/NAV (6.5% discount rate), well above the 0.80x P/NAV multiple that the stock traded at near its lows where it became very reasonably priced earlier this year. Meanwhile, Endeavour Silver now trades at ~10x FY2025 EV/FCF estimates which is not an unreasonable valuation for a name with silver exposure, but I see it as nearly fully valued for a company with all of its operations in a Tier-2 ranked jurisdiction, Mexico and a name with a poor track record of per share growth (*).

(*) As the chart below highlights, while Terronera is a transformational asset that pushes up annual SEO production, the benefits to shareholders are largely muted given that total shares have increased nearly 80% since 2019 (~142 million shares —> ~250 million shares). So, while Endeavour’s top and bottom line benefit from Terronera, there is limited improvement from a per share basis, with annual SEO production per share expected to be roughly flat in 2025 vs. 2019 levels (*)

Endeavour Silver Annual SEO Production, Year-End Share Count + Forward Estimates & SEO Production Per Share – Company Filings, Author’s Chart & Estimates

To put this valuation in perspective, B2Gold Corp. (BTG) is currently paying a 6.3% dividend yield, has a phenomenal track record of per share growth, and trades at just ~7x FY2025 EV/FCF with a more diversified portfolio and much higher margins. Meanwhile, Lundin Gold Inc. (OTCQX:LUGDF) also operates in a Tier-2 jurisdiction but with a far stronger asset (Fruta del Norte) and a very impressive track record of per share growth as well. It trades at ~6x FY2025 EV/FCF estimates or nearly half the multiple of Endeavour Silver. So, adjusted for overall quality (track record, average asset quality, margins), I continue to see far more attractive bets elsewhere in the sector.

So, what’s a fair value for the stock today?

Using what I believe to be fair multiples of 8x operating cash flow estimates and 1.2x P/NAV and a 65/35 weighting to P/NAV vs. P/CF, I see a fair value for Endeavour Silver of US$3.40. This points to the stock being fully valued at current levels which is unfortunate because the stock’s fair value would have been closer to US$4.00 if not for the ~20% share dilution incurred in the most recent quarter alone (and likely more ATM sales in Q2 2024). To summarize, I see no margin of safety at current levels and believe that any upside in Endeavour will require higher silver prices which is not an attractive investment thesis. Instead, I prefer to model conservative metals price assumptions, and find what names are undervalued even using base case assumptions, and take the upside in commodities as a bonus.

In Endeavour’s Silver case, I believe one needs to model a minimum of $30.00/oz silver to justify the current valuation.

Summary

Endeavour Silver had a decent Q1 operationally and saw a meaningful benefit from the gold price strength at Bolanitos which helped to reduce its mine-site AISC. Unfortunately, AISC margins still fell year-over-year, but we will see significant margin improvement in Q2 2024 with AISC margins likely to climb upwards of $6.00/oz. That said, the improved margin outlook is overshadowed by what looks to be up to 25% share dilution this year (over 21% year-to-date) to bring its new lower-cost asset in production. So, while a rising silver price will lift all boats, and Endeavour is undoubtedly a better company with Terronera, I continue to see far more attractive bets elsewhere in the sector today.

If I were looking to put new capital to work today in what I believe to be the most undervalued names, Vox Royalty Corp. (VOXR) stands out as the most attractive. Not only does the business trade at less than 0.70x P/NAV despite a superior business model and 85% margins, but it has the following attractive attributes:

1. The 2nd largest hard-rock royalty portfolio in Western Australia and a portfolio centered around Tier-1 ranked jurisdiction assets (Australia, Nevada, Ontario, Quebec).

2. A strong balance sheet with over $10 million in net cash and no debt, and a growing 2.1% dividend yield.

3. A competitive advantage vs. its royalty peers with an incredible track record of consistently buying a dollar in value for $0.30 or less with a sub 3-year payback on royalty deals to date.

Hence, while EXK might become interesting if it dipped back below US$2.50, I think VOXR is the far more attractive opportunity and trading at a massive discount to fair value with up to 100% upside potential if it were to re-rate in line with its peers, with far greater upside longer-term as it broadens out its portfolio.