#10 “You Can Replace The Bonds In The Traditional 60/40 Portfolio With Gold And It Makes No Difference” – Meb Faber Research

If you read the headline of this article, you probably have the same thought as everyone else:

“No CHANCE”

Meaning, there is no way this headline is true. I mean, how many investors do you know with a portfolio that is 60% stocks and 40% gold? (Ok maybe a few crazy Canadians or Australians?)

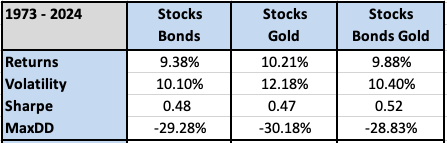

The most iconic institutional benchmark is the 60/40 portfolio of US stocks and bonds. It seems crazy to think that there is nothing special about this allocation. So let’s run a crazy thought experiment and swap out one of the assets, bonds, with another totally unrelated asset, gold, and see what happens. Surely it will crush returns…..right?

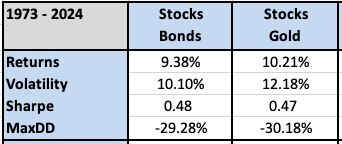

All of the risk and return statistics are just about the same. Some readers will of course respond that the time period is cherry picked, but it holds for the last 100 years too.

Investors love to think it binary terms “Should I own bonds OR gold?!” However, historically the more uncorrelated assets included in the portfolio, the better. So instead of asking “Should I own bonds OR gold?!”, perhaps the question should be “Should I own bonds AND gold?!”

Historically, the answer has been…”BOTH”.

Are gold and bonds just interchangeable?

Not a gold bug but I lived with a Canadian once.