Trulieve Is Still Not A Good Cannabis Stock (OTCMKTS:TCNNF)

bestdesigns

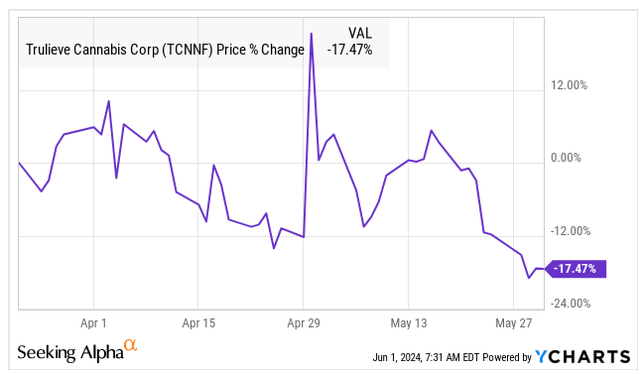

In March, I downgraded Trulieve (OTCQX:TCNNF) from “Hold” to “Sell” and caught a lot of flack from readers that questioned my thinking. After all, we were moving towards rescheduling of cannabis as well as towards Florida voters having the chance to vote in November to legalize cannabis for adult-use in the state. The stock should have benefitted from the announcement by the DEA that it is recommending changing cannabis from Schedule 1 to Schedule 3 and from the ruling of the Supreme Court in Florida that voters will indeed get to vote in November to legalize cannabis. No, though: Trulieve has dropped since that article!

Of course, the stock is still up a lot in 2024. I like to avoid declines like Trulieve has experienced since I initiated my Sell rating, but I am not adding it to my model portfolio yet. In this follow-up, I discuss Q1, which was reported in May, share the updated outlook that analysts have, look at the chart and assess the valuation.

Trulieve Beat Estimates in Q1

On May 8th, Trulieve reported its Q1. Analysts had expected the company to generate revenue of $286 million with adjusted EBITDA of $82 million, both higher than they had been forecasting when the company was about to report its Q4. Trulieve beat these higher estimates! Revenue grew 4% sequentially and from a year earlier to $298 million. Adjusted EBITDA was $106 million, up 21% from a year earlier and 35% sequentially.

The higher-than-expected revenue was just 4% growth from a year ago, and this was better than most of its peers. The gross margin was a healthy 58%, which was up from 54% a year earlier and from 53% in Q4. Florida is where the much of the revenue is generated for Trulieve, and the state is vertically integrated, which results in a higher gross margin than in other states that have wholesaling. Overall, 96% of Trulieve revenue was generated by retail sales. 69% of their stores are in Florida.

Cash flow from operations was $139.2 million, up from $0.4 million a year earlier. The capital spending was just $15.6 million, so the free cash flow was $123.6 million. Investors should understand the source of this improved cash flow, as it is more than just better profitability. Tax-related issues explain a lot of it, with “uncertain tax position liabilities” adding $97.6 million. Deferred income tax added $10 million. A year ago, it had reduced cash flow by $7.9 million.

The balance sheet looks better, but it is being assisted by taxation assumptions. Cash improved by $119 million from year-end, ending at $320.3 million. The company has a lot of debt still, and net debt at the end of the quarter was $162.1 million. Uncertain taxes of $278 million and income tax payable and deferred taxes payable of $218 million are not included in the debt. The current ratio (current assets divided by current liabilities) was a strong 5.0X. Tangible book value was slightly negative. Assuming in-the-money options are exercised, it rises to only $4.7 million. While this is not good, there are many large MSOs with negative tangible book value.

The Trulieve Outlook Has Improved

Ahead of the Q1 report, analysts were projecting growth ahead, according to Sentieo. For 2024, the consensus was that revenue would be $1.152 billion, with adjusted EBITDA of $330 million. For 2025, 10 of the 14 analysts were projecting revenue of $1.224 billion, with adjusted EBITDA of $348 million.

After the beat in Q1, analysts are now expecting revenue to grow 5% to $1.182 billion with adjusted EBITDA of $374 million, up 16%.

For 2025, 13 analysts project now that revenue will increase 5% to $1.245 billion, with adjusted EBITDA of $383 million.

So, all of these estimates have improved. The projected adjusted EBITDA margin for 2025 of 30.8% is down a lot from where it was in 2021 (41%).

These estimates are vulnerable to a big change potentially if Florida, the source of the majority of Trulieve’s revenue, legalizes for adult-use. I watch the Florida medical cannabis market closely, as the state releases data each week. For the week ending May 30th, the data suggests that the growth in medical cannabis patients is the slowest ever at 7.0%. The good news is that it is still growing. The state doesn’t disclose revenue, but it does a fantastic job of sharing company-level information about the number of dispensaries and units sold. Trulieve has 21.3% of the state’s dispensaries and leading market share in THC products (31% of units sold in the past week) and smokeable flower (38% of units sold in the past week).

Data provided by BDSA has shown that the Florida market is growing very slowly. In March, the last month it reported, cannabis revenue in Florida grew only 1.8%, which is less than the patient growth and unit sales growth. The number of stores has expanded at a more rapid rate as well. Clearly, the maturing medical cannabis market has become more competitive, and prices are falling. The lower adjusted EBITDA margin for the Florida-focused company reflects the pricing.

If Florida voters do approve adult-use (60% must do so for it to pass), clearly it will boost sales, but I think that it is difficult to forecast exactly how much. The Florida medical cannabis market is big and mature, and folks who really want cannabis are already getting it. Sure, the state has a very large tourist base, but the tourists don’t go to all of the locations where the dispensaries are located. If cannabis becomes legal for adult-use, those dispensaries that are near where the tourists are will benefit. Investors should look at each of the providers and see how their locations stack up.

The Trulieve Chart Looks Toppy

Trulieve is up 87.7% in 2024 despite this sharp pullback since April 30th. The New Cannabis Ventures Global Cannabis Stock Index is up 16.5% year-to-date, which is now better than the NCV American Cannabis Operator Index, which is up 12.3%. The stock set an all-time low before the DEA rescheduling rumor hit the market in late August, closing at $3.45 on 8/28. It’s up 183% since then. The American Cannabis Operator Index has rallied 53% since 8/28.

I have not been bearish on Trulieve’s stock for long. I was actually very bullish about a year ago, when I wrote my first article that called it an excellent entry. The stock then was $3.87. In November, after the stocks had turned up, I reiterated my bullishness after the stock had rallied to $5.61. In mid-January, I changed from “Buy” to “Hold”, calling the stock cheap but perhaps risky. It had gone up to $6.78 then. My first “Sell” on it was in March, and the stock was up 127% year-to-date at $11.85.

I didn’t have a “Buy” article that I wrote at the very bottom, but my two articles (one before and one after the bottom and both with “Buy” ratings) worked out very well. Going “Neutral” made sense at the time, but perhaps I should have waited. The “Sell” article was early, as the stock spiked on April 30th, the day the DEA confirmed that it was going to advocate rescheduling cannabis. It is lower now.

When I went from “Buy” to “Neutral”, I cited the gap in trading near $6 from mid-January. I no longer believe that this gap will necessarily get filled. I see support at $7 above that. In fact, I think that stock could find a bottom in the 8s. I see resistance at the falling 50-day moving average of 11.52 as well as higher.

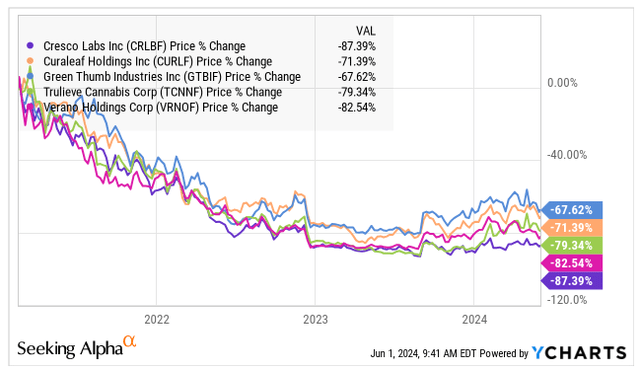

Taking a look at the longer-term trading, it is pretty clear that Trulieve has been liked a lot more than now historically:

First, note that the recent peak was below the spike from early December 2022. I know that a lot of traders and investors look at the old highs and imagine that a stock can get back. Sure, Trulieve could get back to the 50s, but this is not my projection for at least the next 5 years. I share a target for year-end below, but if I pushed the valuation I project a lot higher and that Trulieve can grow more rapidly, it could get there eventually. If I take the projected adjusted EBITDA for 2025 and assume it grows for 5 years at 15% and put a multiple of 20X on it, I would get to the high 70s at the end of 2029, so it is possible. I think that the multiple is likely too high, and I don’t expect the growth to be that high either. 10% growth and a 15 multiple would fall short of $50.

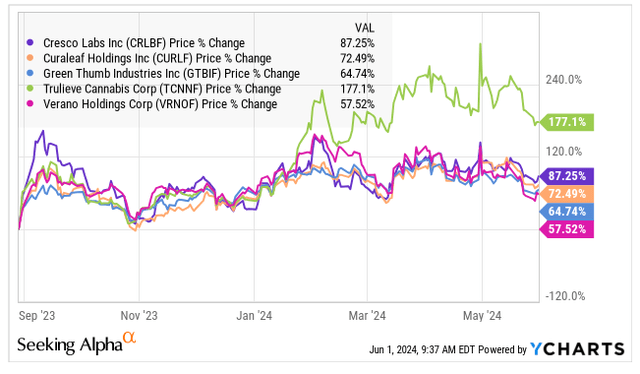

Looking at Trulieve relative to its four Tier 1 MSO peers, which includes Cresco Labs (OTCQX:CRLBF), Curaleaf (OTCPK:CURLF), Green Thumb Industries (OTCQX:GTBIF) and Verano Holdings (OTCQX:VRNOF), it has outperformed substantially since 8/29, the day before the stocks took off on the rescheduling rumor (when the Department of Health & Human Services recommended that the DEA move from Schedule 1 to Schedule 3):

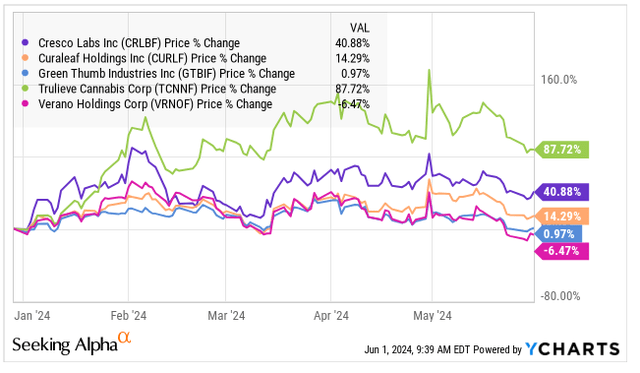

They are all up a lot, but not nearly as much as Trulieve, which benefitted I believe from speculation regarding Florida potentially legalizing for adult-use. This is more evident in the year-to-date chart:

One stock, Verano, is actually down in 2024. It has declined a lot since mid-April, when I said it was no bargain.

Taking a longer-term perspective, Trulieve has moved in line with its peers since the end of 2020:

Trulieve’s Valuation Is Not Bad

When I last wrote about Trulieve and initiated a “Sell” rating in March, I had a target of $16.65 in the optimistic scenario and one that was much lower if rescheduling of cannabis didn’t take place. This was based on an enterprise value of 10X projected adjusted EBITDA for 2025.

While I am not certain that the DEA will actually succeed in rescheduling, which would do away with 280E taxation, I now target with the assumption that it will take place. In a preview of the Q1 report, I shared with members of my investment group a target that was revised to 8X, and this was $13.12 at that time.

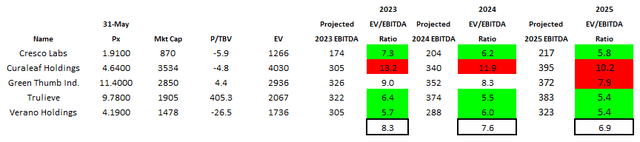

With the higher estimate and still using 8X, I get $14.90, which is 52% higher than the $9.78 current price and above my third resistance level. Of course, 8X might be too low, but note that the average current ratio for the Tier 1 MSOs for EV/adjusted EBITDA for 2024 is 7.6X:

Alan Brochstein, using Sentieo

Looking at 2025, the ratio for Trulieve is the lowest and just a little over half of the Curaleaf valuation. I recently upgraded Green Thumb Industries to “Neutral” from “Sell” and maintain a “Strong Sell” on Curaleaf.

So, Trulieve has a decent valuation. My issue, though, is that it isn’t that much better than the peers except for Curaleaf. Worse, though, there are some Tier 2 names that are much cheaper. The one that stands out is Ascend Wellness (OTCQX:AAWH), which is a buy up just slightly in 2024. For those that want to invest in Florida’s potential adult-use legalization, I continue to recommend Planet 13 (OTCQX:PLNH), which I last wrote about three weeks ago, calling it the best American cannabis stock.

Conclusion

There is a lot of good going on for Trulieve, as I discussed. But, its price has soared. There are some risks too, including Florida not legalizing for adult-use. Of course, the company has taken an aggressive position on taxes and may have to pay with some of its cash.

I have gotten more constructive on cannabis stocks given the move by the DEA to reschedule, but it’s not yet a done deal. For those who are optimistic, I think that there are better choices for MSOs than Trulieve, and some of the ancillaries make more sense too. While its price is lower, I still believe that Trulieve should be sold and replaced.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.