Medifast: Significant Undervaluation Even As Struggles Persist (NYSE:MED)

Tony Anderson/DigitalVision via Getty Images

Investment thesis

As I suggested in my initial cautious thesis about Medifast (NYSE:MED), the company faced tough times over the last seven months. The emergence of drug-weight loss weighs on Medifast’s business, and its financial performance is deteriorating rapidly. The stock is extremely undervalued and there is a potential for a turnaround, but it is unlikely to be an overnight process. All in all, I reiterate a “Hold” rating for MED.

Recent developments

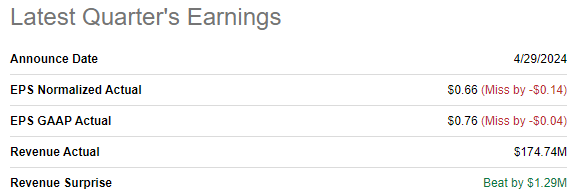

Medifast reported its Q1 earnings on April 29, topping revenue consensus estimates but missed EPS forecasts. Revenue decline accelerated with a 50% YoY drop. The adjusted EPS shrunk multiple times YoY, from $3.67 to $0.66. Despite a two-percentage gross margin expansion, the massive revenue drop has led the operating margin to shrink from 15.3% to 5.3%.

Seeking Alpha

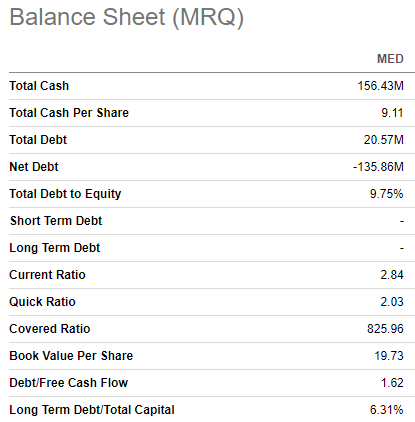

Medifast’s free cash flow [FCF] folded by eleven times YoY, from $55 million to $5 million. Despite a drawdown in FCF, the balance sheet is still strong with $156 million in cash and very low debt levels. Liquidity metrics are also robust, suggesting that the balance sheet is well-rounded, and the company has ample financial resources to invest in new initiatives to revitalize growth.

Seeking Alpha

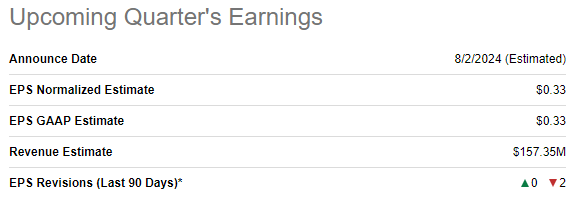

The upcoming earnings release is scheduled for August 2. Consensus estimates forecast Q2 revenue to be $157 million, indicating a 47% YoY drop. The adjusted EPS is expected to dip further, to $0.33 YoY, or by two times sequentially.

Seeking Alpha

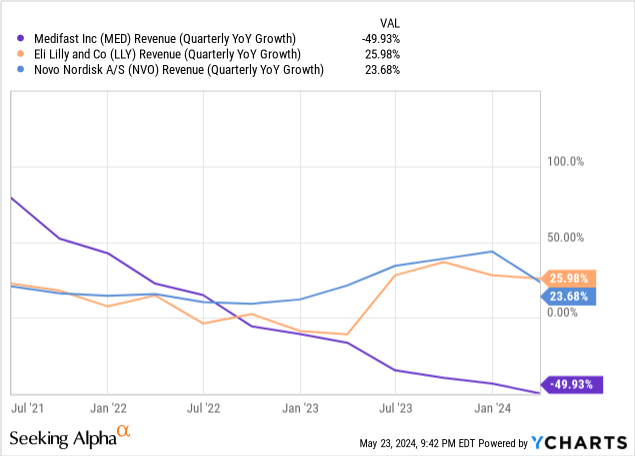

The company’s revenue continues falling like a rock, as the company continues facing challenges due to the evolving landscape in the weight loss industry stemming from emerging GLP-1 drugs offered by U.S. pharmaceutical giant like Eli Lilly (LLY) and Europe’s largest public company, Novo Nordisk (NVO)

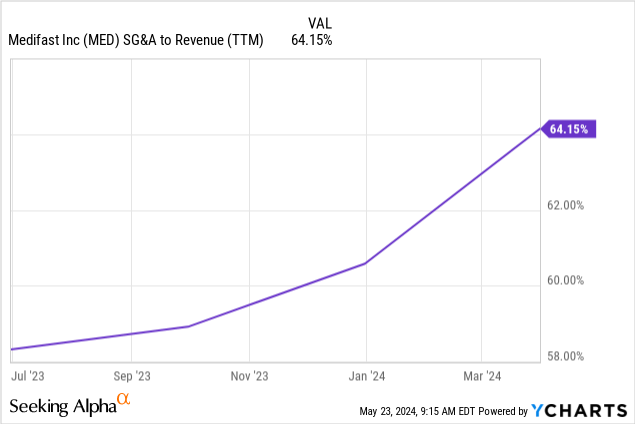

Sharp revenue decline has led to even sharper effect on the company’s bottom line as leverage on fixed costs melted. As a result of this effect, the company’s SG&A to revenue ratio is gaining exponential momentum.

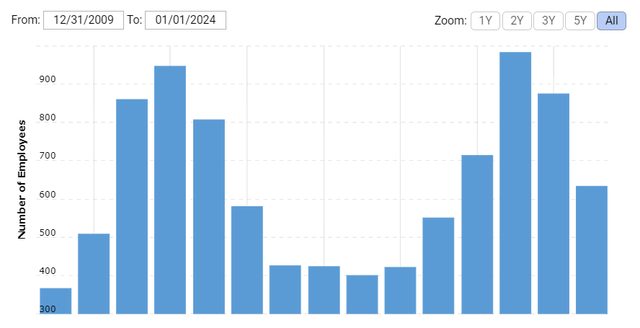

Fresh news suggest that Medifast is laying off 62 employees due to the closure of the Maryland warehouse. However, considering the fact that revenue is halving, it is reasonable to expect that the company needs to boost its layoffs pace. According to macrotrends.net, the company’s headcount peaked at 984 in 2021 when the company generated $1.5 billion full-year revenue. Since consensus estimates forecast $0.6 billion revenue in FY 2024, the headcount should correlate with revenue shrinkage. That is, to match the revenue drop, MED’s headcount should be around 400 workers, way below its 634 employees as of December 31, 2023.

Cutting down the headcount to around 400 workers is doable. According to the same source, the company had 420 employees in 2019 when it generated $0.7 billion in revenue. Technologies have evolved since then, and I believe that will all new technological features, including generative AI, it is real for the company to sustain a $0.6 billion revenue with 400 employees.

However, this measure will be controversial and can adversely affect the remaining employees’ morale. Moreover, Medifast’s image of one of the America’s best employers might significantly deteriorate.

I do not see other quick measures for Medifast to at least partially protect shareholders’ value. GLP-1 weight-loss drugs are a real threat to Medifast’s revenue growth. The market is expected to grow with a 21% CAGR by FY 2032. We can see below that Medifast’s revenue growth dynamic moves in opposite directions with LLY and NVO, and weight-loss drugs is the reason of such trend.

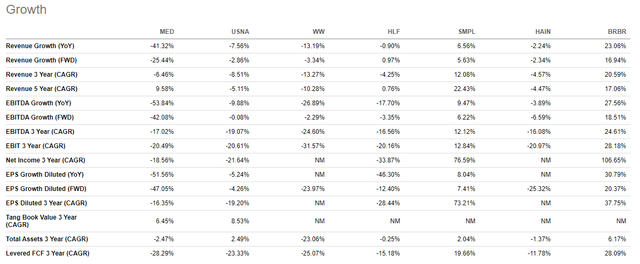

Another factor that makes me pessimistic is Medifast’s recent performance compared to its peers. In the latest 10-K report, the below tickers were named as the company’s direct competitors, meaning that comparing them with MED will be sound. As shown below, Medifast’s rivals are dealing with GLP-1 challenges much better. This is evident from YoY and FWD revenue and EBITDA dynamics. While other companies demonstrate moderate decreases or even slight growth, Medifast’s key metrics are nosediving.

Valuation update

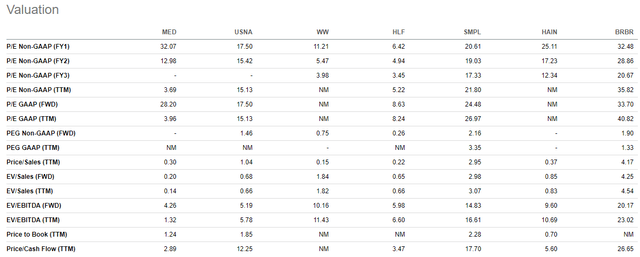

Medifast valuation ratios are mostly lower compared to peers, but it is fair given the revenue and EBITDA underperformance. Seeking Alpha Quant gives MED the highest possible “A+” valuation grade, but I want to cross-check it with the discounted cash flow [DCF] simulation.

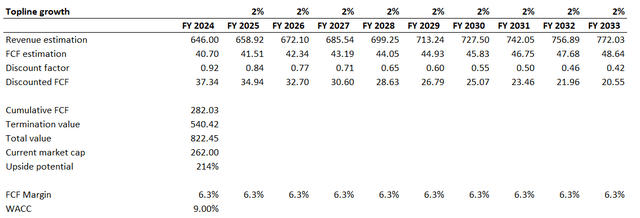

I use a 9% WACC for my DCF. I am using an FY2024 consensus estimate for revenue and project a 2% growth for the next decade, in line with long-term inflation averages. I expect that without revenue growth, the FCF margin will stay flat at the TTM 6.3% level.

According to my simulation, the business’s fair value is $822 million. This is around three times higher compared to the current market capitalization, indicating massive undervaluation. On the other hand, the deep discount is fair given the rapidly deteriorating financial performance and the absence of a swift turnaround plan from management.

Risks to my cautious thesis

When I say that the management does not have a swift turnaround plan, it does not mean they are not taking any action. The company collaborates with LifeMD to enhance its value proposition. The aim is to combine Medifast’s OPTAVIA Coach support with LifeMD’s clinician care and technology platform. According to Medifast’s release announcing the collaboration, the partnership is expected to improve operational efficiencies, expand market reach, and expand the customer base. However, since it is a new endeavor, the level of uncertainty is high, and it is difficult to expect a rapid effect from this collaboration.

As I mentioned in recent developments, Medifast’s balance sheet has almost no debt and more than $150 million in spare cash. The FCF is still positive despite a massive revenue growth. This means that the company still has notable financial flexibility to finance new growth initiatives to build long-term value for shareholders.

Bottom line

To conclude, I reiterate my “Hold” rating for Medifast. Financial performance looks poor, especially when we add the performance of rivals to our discussion. On the other hand, the company has the potential for a turnaround over the long run, which is backed by a solid financial position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.