#2: “Stocks Can Underperform Bonds for a Long, Long Time” – Meb Faber Research

If you asked the average investor to name the most iron rule of investing, they’d likely say: “Stocks outperform bonds.” And yes, over the long haul, that’s been true.

Since 1900 US stocks have returned 9.9% and 10-year US government bonds about 4.4%, a mile-wide gap.

But the key question most folks never ask is… how long is long enough?

Most people would likely say a few years. True believers would say an entire decade.

The problem is that history is a brutal teacher, and she doesn’t care about your expectations.

Most people could only last a short amount of time underperforming before giving up. The correct answer to “What is the longest stretch of stocks underperformance vs. bonds?”

68 years.

Let that sink in. You could theoretically go an entire lifetime without seeing any equity risk premium.

Now, this 68-year stretch occurred over 100 years ago, so you might be tempted to dismiss it.

In modern times, there have been multiple periods during which stocks have underperformed for decades. (And this is just in the US…other countries have suffered far, far worse…) Given the results of my Twitter poll, it means many respondents would likely bail on stocks much sooner.

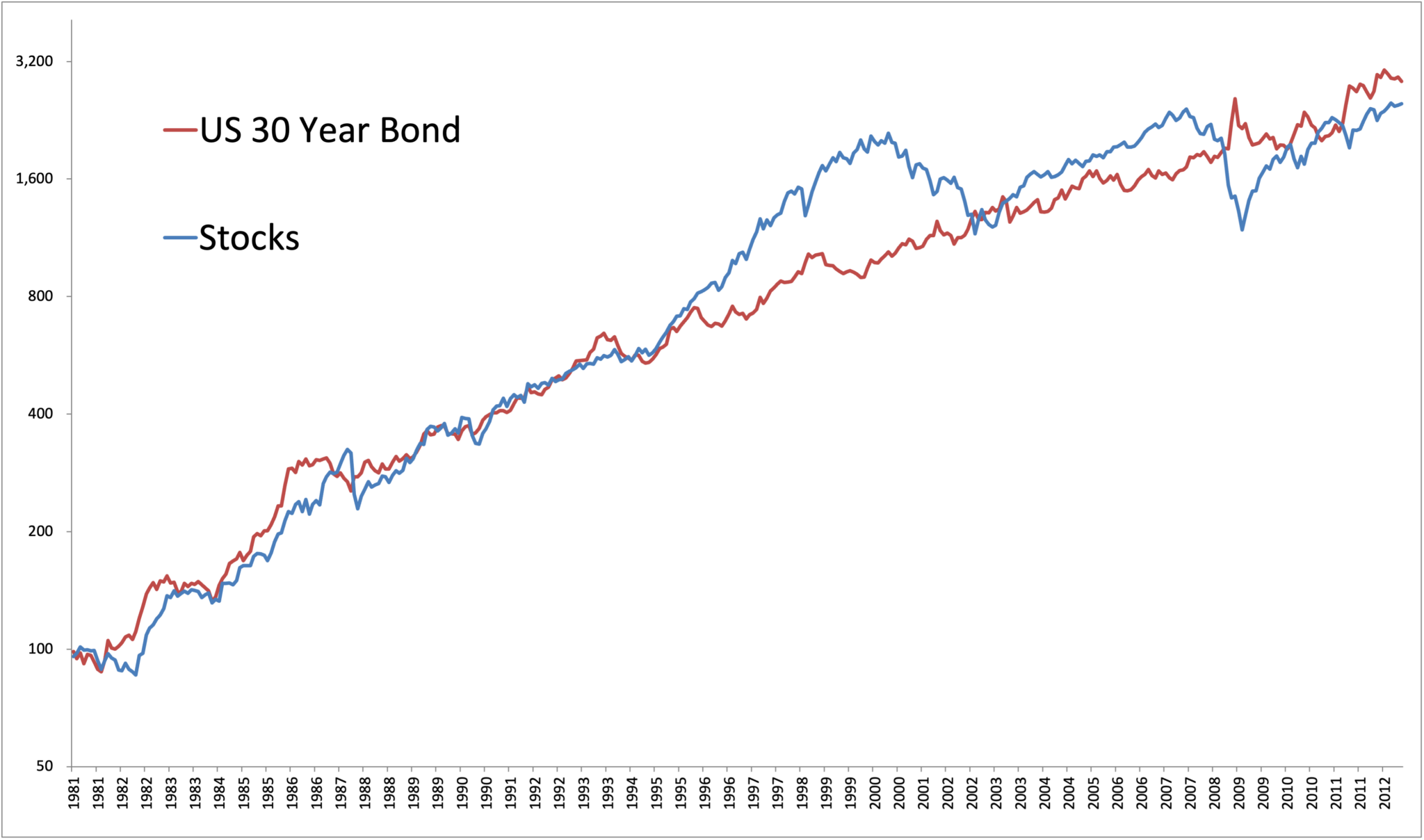

Let’s zoom in on this century. If you plowed money into U.S. stocks at the start of the century, you got whacked with two massive drawdowns—the dot-com bust and the GFC. And despite a heroic recovery post-2009, stocks still couldn’t outrun a basic bond portfolio over the full stretch.

Two. Decades.

Think about that. An entire investing generation—new grads, young families, retirees—could have spent their whole working life watching the “safe” stuff quietly outperform the market darling. And let’s be clear: we’re not talking fancy hedge funds or tactical alphas. This is a plain-vanilla, middle-of-the-road bond portfolio.

If you used the 30-year bond you could take it back to 1980…or three, perhaps four decades of no material equity premium.

Why does this matter? Because it flies in the face of one of the most ingrained assumptions in finance. And because most investors—retail and pro alike—chronically underestimate the length and depth of underperformance that can happen in markets. We’ve just experienced massive stock outperformance over bonds over the past 15 years. Will that continue forever?

We’re taught to think of bonds as ballast. Income-generating sleep aids. But there are times when they’re the better bet—not in hindsight, but in real time, if you’re paying attention to valuation and risk premiums.

What’s the takeaway?

- Stocks don’t always win.

- Timeframes matter. A lot.

Diversification isn’t just a nice idea—it’s survival. And if your allocation is anchored in dogma (“stocks for the long run!”), you might be in for a rude awakening when “long run” turns into “not in your lifetime.”