10 Reasons To Buy Lululemon (NASDAQ:LULU)

Robert Way

Introduction

Lululemon Athletica Inc. (NASDAQ:LULU) has been on my radar for quite some time now, but I couldn’t fathom buying the stock at $400 or $500 when shares were trading at 40x to 50x its earnings. However, Lululemon stock has sold off more than 40% since the start of 2024, bringing its valuation down to much more reasonable levels.

At less than $300 a share, Lululemon is beginning to look like an attractive long-term investment. Although shares did trade below $300 a little over a year ago, I missed the opportunity to initiate a position as I was busy accumulating shares of its peer, On Holding AG (ONON), which, at that time, was trading at a much better risk-to-reward profile than Lululemon. You can read my latest ONON article here.

Fortunately, the markets gave me yet another opportunity to buy Lululemon stock. So, for the last few weeks, I have been studying the company, its fundamentals, and its financials — the byproduct is this mini deep dive.

And after all is said and done, I have compiled 10 solid reasons to buy Lululemon stock under $300 a share.

With that said, let’s go over each of those reasons.

Reason #1: Unique Brand Moat

Lululemon was founded by Chip Wilson back in 1998 in Vancouver, Canada. The idea for Lululemon hit Wilson when he attended a local yoga class and noticed that women didn’t have access to yoga-specific apparel that was comfortable, fashionable, and athletic. Realizing that yoga will eventually be a much bigger sport in the future, Wilson decided to start Lululemon to create the best yoga clothing for women.

The company started out as a design studio and a space for yoga classes, but after engaging with the local yoga community and receiving feedback from yoga instructors, Lululemon officially launched its first store in November 2000 in Canada. Its first product was a pair of yoga pants.

Lululemon quickly gained popularity, opening additional stores nationwide. In 2003, the company introduced its first US store in Santa Monica. Consumer demand was off the charts — outside capital was necessary to keep up with this demand. As such, Lululemon went public via IPO in 2007 — and the rest is history.

Through the perfect blend of functionality and design, Lululemon aims to elevate human potential by helping people feel their best.

Undoubtedly, Lululemon has grown to become one of, if not, the largest and most successful premium athletic apparel brands in the world, offering high-quality technical athletic apparel, footwear, and accessories across multiple sports categories.

Despite heavy competition in the athletic apparel industry, Lululemon is regarded as the gold standard in yoga and active clothing globally, which speaks volumes about the company’s strong brand moat.

In the apparel industry, brand advantage is of the utmost importance.

Lululemon’s unique brand and how it continues to resonate with a growing number of people with each passing day — not just for yoga and Pilates enthusiasts — will be the key determining factor that keeps Lululemon growing over the next decade or so. Combining a strong brand with premium positioning, Lululemon should be able to sustain pricing power for long periods of time, translating to solid earnings growth for shareholders eventually.

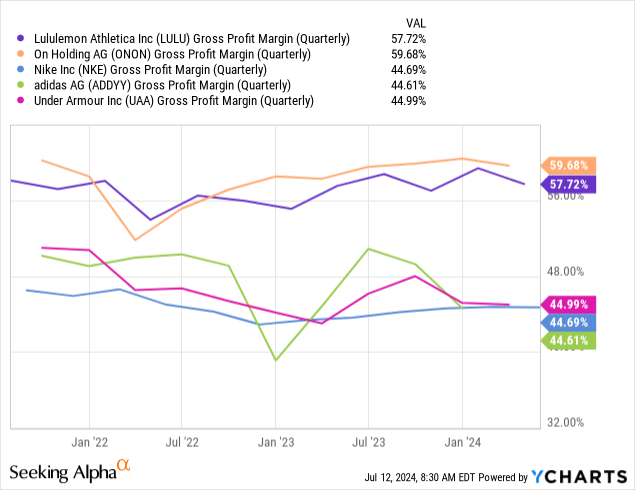

Reason #2: Industry-leading Gross Margins

A company’s Gross Margin profile can give us a clue about its competitive advantage — and how sustainable it is.

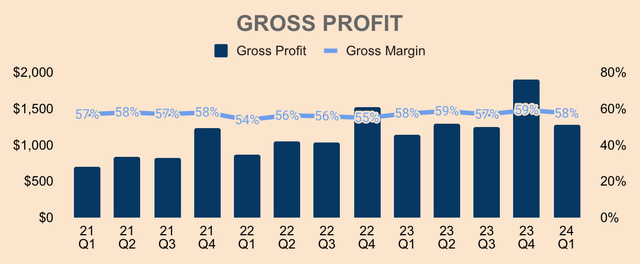

In Q1, Lululemon produced $1.3B of Gross Profit at a 58% Gross Margin. As you can see below, not only has Lululemon grown Gross Profit over time, but the company has also kept Gross Margin relatively stable over the last three years.

This is despite supply chain disruptions, waning consumer sentiment, surging inflation, ongoing international expansion, and rising competition. In my view, that is a remarkable display of brand loyalty and pricing power.

Lululemon’s products are not exactly cheap. In fact, they are darn expensive.

And yet, people still buy them.

So that says a lot about Lululemon’s moat.

In addition, over a longer time frame, Lululemon has actually grown its Gross Margin profile. This shows economies of scale within Lululemon’s business model.

- In 2015, Gross Margin was 48%.

- In 2023, Gross Margin was 58%.

At the same time, Lululemon has one of the highest Gross Margin in the industry, far surpassing giants like Nike (NKE) and Adidas (OTCQX:ADDYY), which have Gross Margins of about 45%. The only close peer that has an edge over Lululemon is On Holding, which has a Gross Margin of nearly 60%.

Nevertheless, both Lululemon and On Holding are in a class of their own, which explains my relative bullishness on premium brands over mainstream brands.

Why? Because higher Gross Margins mean higher earnings potential.

To recap, Lululemon’s high and rising Gross Margin means that the company has:

- Strong pricing power in a highly competitive industry.

- Economies of scale to drive incremental value.

- Higher earnings potential relative to peers.

Reason #3: Growth Compounder

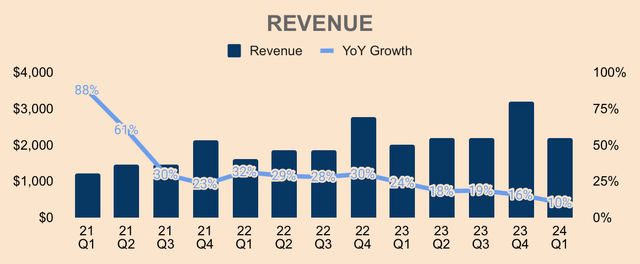

Lululemon has grown like wildfire. Over the last 10 years, Lululemon has increased its Revenue by seven-fold, from $1.4B in 2013 to $9.8B in 2023. On an annual basis, Lululemon has NEVER failed to grow its Revenue, which shows how great the brand is, how strong execution has been, and how popular athleisure has become.

While growth has been phenomenal since inception, it’s important to note that growth has been slowing down over the last few quarters. As you can see, Lululemon’s growth has fallen from high double-digits to just 10% as of the most recent quarter, where Lululemon registered $2.2B of Revenue.

Despite the slowdown, I think a 10% growth for a high-discretionary brand amidst high-interest rates, soaring inflation, and poor consumer sentiment, is pretty impressive. As the macro picture improves — especially when rates go lower — I believe we should see a nice rebound in growth.

With that being said, let’s investigate what caused the slowdown in Lululemon’s growth.

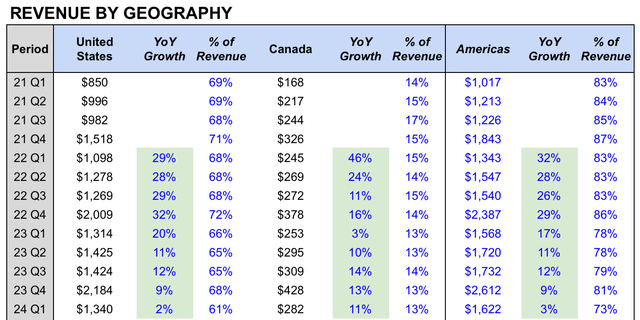

For one, the slowdown was caused by the rapid deceleration in Lululemon’s largest and most important market: the United States. As you can see below, Revenue in the US was $1.3B in Q1, up only 2% YoY. Fortunately, this was not due to a “brand” or “competition” problem, but rather, due to a softening in consumer sentiment as well as missed opportunities in terms of product color and sizing.

Nevertheless, this was a major concern for investors, as the US makes up more than 60% of the company’s total Revenue. The rapid slowdown in the US market is probably the main reason why the stock sold off 40%, fearing that the US segment may see its first YoY decline in a long time. Because of this, many conclude that Lululemon’s growth story might just be over.

I digress.

Though not shown above — due to reporting changes that left some data incomplete — Lululemon is still showing robust growth outside the US. More specifically, China Mainland is the clear outlier, growing 67% YoY and 45% YoY in 2023 and Q1, respectively.

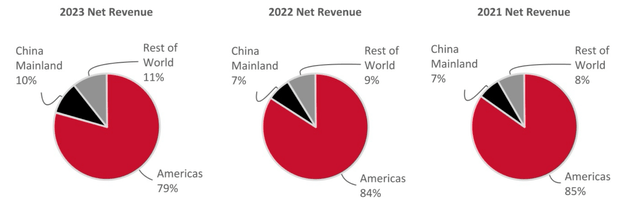

It’s important to note that China Mainland only makes up 10% of total Revenue in 2023, so the region has much more room for growth, especially given the fact that China has the second-largest population in the world at about 1.4B people, which is over four times the US population.

Additionally, Rest of the World is also growing healthily, up 43% YoY and 27% YoY in 2023 and Q1, respectively. Similar to China Mainland, Rest of the World makes up only 11% of total Revenue in 2023.

Put differently, there’s still so much more room for growth in markets outside of the Americas. In fact, management sees the potential for international Revenue to make up half of the entire business.

Our international business remains under-penetrated and continues to represent a significant growth opportunity. For the full year 2023, international was only 21% of our business, and over the long run, I see the potential for it to grow to 50% as we continue to expand our presence outside of North America.

(CEO Calvin McDonald — Lululemon FY2024 Q1 Earnings Call, emphasis added.)

Moreover, Lululemon is predominantly an apparel business with about 88% of its Revenue coming from apparel — its Other segment makes up 12% of Revenue in Q1, which consists of accessories, Lululemon Studio (formerly MIRROR), and footwear. That said, there’s still a long growth runway in the “Other” category, which should be a key driver of growth for years to come.

In the same token, Lululemon Men’s category is still in the early stages of growth, comprising only 23% of total Revenue in Q1. I find myself regularly visiting Lululemon stores these days, so I think there’s still potential for the Men’s segment to grow — a year ago, the idea of entering a Lululemon store seemed ridiculous to me, so a change in my perspective says a lot about the Lululemon brand.

Whatever it is, Lululemon has been a growth compounder over the last two decades, and although past results are not indicative of future performance, I believe Lululemon has what it takes to continue to compound growth over the coming years or so, especially considering its strong brand moat and its track record of strong execution.

Reason #4: Vast Untapped Opportunities

Yes, management guided for a meager 11% to 12% YoY growth in 2024 — it pales in comparison to 2023’s growth of 19%. However, expect a re-acceleration of growth as its pipeline of innovation and inventory situation look more favorable in the back half of the year.

I’m optimistic with regards to our performance in the second-half of the year and beyond as we continue to execute well against our Power of Three x2 goal of doubling our Revenue in five years.

(CEO Calvin McDonald — Lululemon FY2024 Q1 Earnings Call, emphasis added.)

With that being said, as I’ve mentioned in the previous section, Lululemon still has a long growth runway ahead given its low market share in international markets, menswear, and non-apparel categories.

Furthermore, the Lululemon brand is still regarded as a “yoga” brand and has yet to build a substantial presence in other sports categories, including running, golf, and training — all of which Lululemon is investing heavily in currently.

Moreover, Lululemon has recently entered the footwear category in 2022, so Lululemon’s footwear business still has a lot more room to run — pun intended.

For reference, Nike generated more than $35B of Footwear Revenue in 2023. I’m not saying that Lululemon’s footwear unit will get to that level, but assuming just 10% of that $35B, the idea of Lululemon footwear achieving that kind of scale doesn’t seem so crazy after all.

Nonetheless, the success of its footwear business hinges on the company taking market share in a highly competitive industry. Fortunately, Lululemon’s apparel business has done just that over the last 25 years — I don’t see why it can’t do the same in the footwear category (or in any other major category, for that matter).

And in terms of share, in Q1, we did gain market share in both the U.S. adult apparel industry as well as the U.S. adult active wear industry. We saw outsized gains in men’s where we significantly outperformed the overall market. In women’s, we were flattish based on the missed opportunities that I identified.

(CEO Calvin McDonald — Lululemon FY2024 Q1 Earnings Call, emphasis added.)

Another growth opportunity for Lululemon would be to monetize its member base, which is 20M strong as of Q1. Currently, its membership program offers benefits such as early access to new products, hemming, and exchange or credit on sale items — all at no cost to members.

What if Lululemon starts to offer a premium tier whereby premium members get a 10% discount on all Lululemon products and other exclusive benefits like free shipping, for, let’s say, $30 a month?

Mind you, Lululemon targets high-income earners who don’t mind spending $100 on a pair of yoga pants or a running shirt, so $30 a month would not be a big deal to them. Therefore, I think a lot of Lululemon’s followers would sign up for this program, and this will benefit Lululemon in many ways:

- Allows Lululemon to generate stable, high-margin subscription Revenue.

- Increases brand loyalty.

- Increases spend per customer.

Of course, this is pure speculation on my part — but I believe this is a massive untapped opportunity for Lululemon. And along with low unaided awareness, low international market penetration, and low exposure to other sports and categories, I believe Lululemon has a massive runway ahead as it continues to dominate in the world of athleisure and activewear.

Reason #5: Robust Profitability

While Lululemon grows its top line, investors can rest assured that its bottom line will grow as well.

As previously discussed, Lululemon has a high Gross Margin of 58% that is both industry-leading and expanding. Moreover, the company produces high Operating Margins of 20%+. Quarterly Operating Margins look lumpy due to retail seasonality, but over the last twelve months, Lululemon has generated $2.2B of Operating Profits at an Operating Margin of about 23%.

Additionally, there are still opportunities for margin expansion in the long term.

- Firstly, the company is still investing in driving growth through brand initiatives and marketing campaigns, which contributed to a 80bps deleverage on margins.

- Secondly, Lululemon’s international operations have not scaled enough to achieve optimal margin levels. For example, its Rest of World segment only has a 19.7% Operating Margin, rather than 38.5% for the more mature Americas market. Notice how the Rest of World segment is gaining significant operating leverage, as seen by the 530bps YoY increase in Operating Margin — I expect this trend to continue as the segment scales. In another instance, in Q1, China Mainland had an Operating Margin of 39%, expanding 400bps YoY — China’s growth should also drive overall margin expansion.

That being said, Lululemon exhibits robust bottom-line numbers.

- In 2023, Net Income was $1.6B at a 16% Net Margin. EPS was $12.21, up 83% YoY (EPS growth looks terrific due to a large impairment of goodwill related to Lululemon Studio in 2022). For 2024, management expects EPS of $14.27 to $14.47, implying an 18% YoY growth.

- In Q1, Net Income was $321M at a 15% Net Margin. EPS was $2.54, up 11% YoY. For Q2, management expects EPS of $2.92 to $2.97, implying a 10% YoY growth.

Earnings have been volatile over the last few years due to certain asset impairments, restructuring costs, and inventory provisions. Adjusting for these items, Lululemon’s profitability remains robust and is trending in the right direction, which should deliver solid earnings growth for investors moving forward.

Reason #6: Expanding Balance Sheet

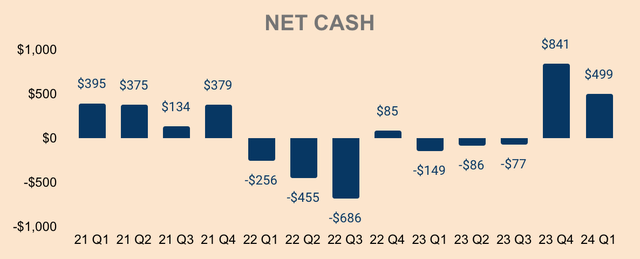

As of Q1, Lululemon has $1.9B of Cash and Short-term Investments and $1.4B of Total Debt (mostly in the form of Operating Lease Liabilities), placing its Net Cash position at about $0.5B. Not the best balance sheet by any means, but it does have a positive Net Cash position and the company is highly profitable — so overall, Lululemon is in a healthy financial position.

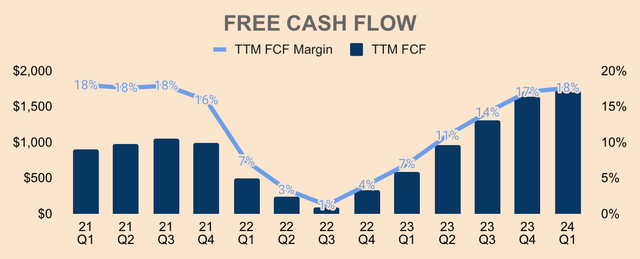

Besides, Lululemon is a cash flow machine. Quarterly cash flows are lumpy due to seasonality, but if we look at Lululemon’s TTM Free Cash Flow below, we can see that the company has been growing its cash flows over time, except for 2022 when the company was building its inventory.

As of Q1, TTM FCF was $1.7B, representing 18% of TTM Revenue. Judging by the trend of the graph below, it’s reasonable to assume that Lululemon will achieve a TTM FCF Margin of 20% by the end of 2024.

You might be wondering if Lululemon is so FCF positive, why hasn’t its Net Cash grown over time?

Well, the company continues to invest for growth, with Capital Expenditures representing about 7% of Revenue. In 2024, management expects Capital Expenditures to be about $0.7B, mostly for new store openings and its multi-year distribution center project.

Another reason why Net Cash has been stagnant is because Lululemon has been buying back shares quite aggressively. For reference, Lululemon bought back $555M and $297M worth of stock in 2023 and Q1, respectively.

Management has also expanded its buyback program by $1B, bringing its total buyback authorization to $1.7B as of June. Considering the stock’s violent selloff, I expect the company to cannibalize itself at a relatively elevated pace, bringing shares outstanding down and boosting EPS growth in future quarters.

I believe that is a sensible use of excess capital at the moment. Regardless, with a much improved FCF profile now than ever before, I expect its Net Cash balance to expand moving forward, solidifying its financial position.

Reason #7: Excellent Capital Allocator

Whether it is for growth or buybacks, I have full confidence in management’s capital allocation strategy. That’s because Lululemon is one of, if not, the most capital-efficient companies in the industry.

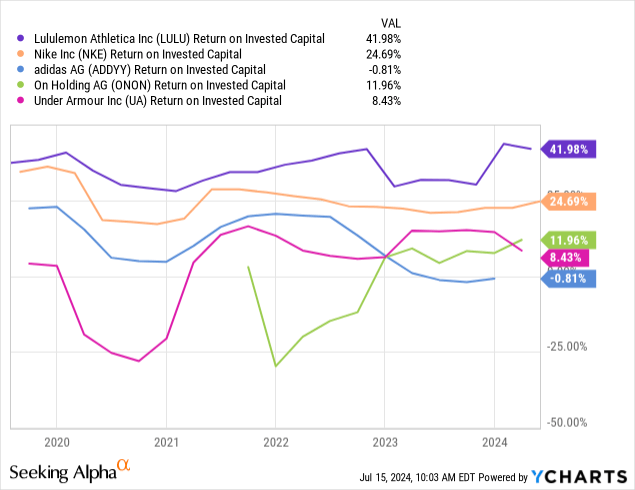

As you can see, Lululemon has an ROIC of 42% as of Q1, outperforming its peers by a massive margin. Based on my research, the best-performing stocks have sky-high ROIC, and Lululemon has sustained 25%+ ROIC over the last five years, which says a lot about management’s execution and capital allocation prowess.

The Mirror acquisition aside, I can sleep well at night knowing that management will put their capital to good use, generating strong shareholder value eventually.

Reason #8: Unwavering Culture

Besides being excellent capital allocators, Lululemon management are great leaders as well, fostering a strong culture with the shared vision to “create transformative products and experiences that build meaningful connections, unlocking greater possibility and wellbeing for all.”

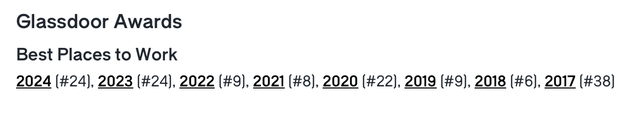

Sure, there were several controversies and multiple CEO changes before the appointment of current CEO Calvin McDonald. However, ever since he took over the company in 2018, Lululemon has been recognized as the top 30 Best Places to Work according to Glassdoor… get this… for seven years in a row!

Now that is a feat not many CEOs can claim to have achieved.

Seven years in a row doesn’t happen by chance — it happened through creating an unwavering culture committed to the mission and vision of the company. Simple, but profoundly difficult.

The people of a company can make or break the company. Fortunately for Lululemon, the company has an excellent CEO at the helm. He has played a massive role in the success of the company — and he will continue to do so for the foreseeable future.

Reason #9: Multiple at a 10-Year Low

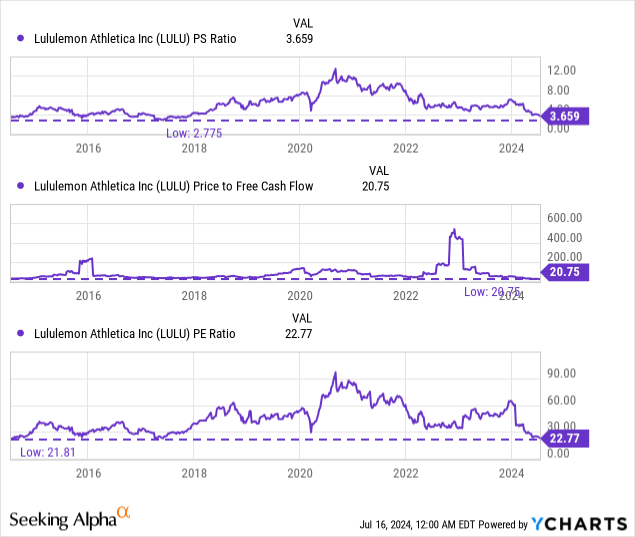

Lululemon stock is arguably sitting at the lowest valuation in 10 years. Based on the current share price of $283, Lululemon is trading at:

- 3.7x Price to Sales — relative to its 10-year low of 2.8x and peak of more than 12.0x.

- 20.8x Price to FCF — which is a new 10-year low.

- 22.8x Price to Earnings — which is a hair away from its 10-year low of 21.8x.

Now, a P/E ratio of 22.8x is not necessarily cheap, but based on its historical multiple, Lululemon is basically trading at its cheapest valuation from the last 10 years. This is despite Lululemon being a much larger and more profitable company than ever before.

Yes, growth is slowing down. Yes, competition is rising. Yes, consumer sentiment is low. But these are known problems, and I think they have already been baked into the stock price.

Whatever the reasons for the selloff, it’s still worth remembering the core investment thesis for Lululemon stock, namely reasons #1 to #8. Adding the stock trading at the lowest valuation in 10 years, I believe investors can accumulate Lululemon stock at a wide margin of safety.

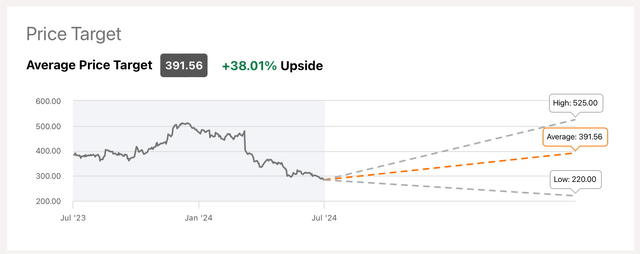

That said, analysts are overall bullish on Lululemon with an average price target of $391, representing an upside potential of 38%. There are 23 Buy, 9 Hold, and 3 Sell ratings on the stock.

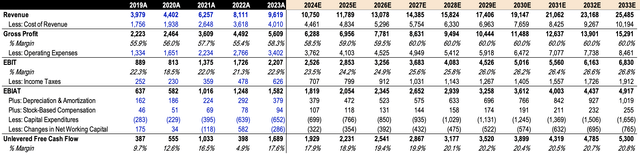

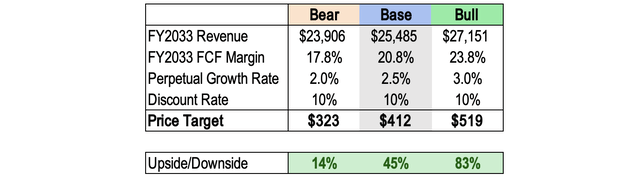

My 10-year discounted cash flow (“DCF”) model also shows that there’s value at current prices. Below, I’ve included my DCF projections, with the following key assumptions:

- Revenue growth follows analyst estimates for the first three years. For the remaining years, I kept growth constant at 10% annually.

- Gross Margin and Operating Margin will gradually expand to 60.0% and 26.8%, respectively, as Lululemon continues to gain operating leverage.

- Income Tax Expense will be set at 28.0% of Operating Income.

- Capital Expenditures will be set at 6.5% of Revenue.

By 2033, I expect Revenue of $25.5B at an FCF Margin of 20.8%, which is only about 3 percentage points higher than 2023 levels, so this is fairly conservative.

Assuming a perpetual growth rate of 2.5% and a 10% discount rate, I arrive at a base-case price target of $412 for Lululemon stock, which is about a 45% upside from current prices.

I have also included my bear and bull cases below.

Having said that, following its 40%+ decline, I believe Lululemon stock is significantly undervalued with decent upside potential.

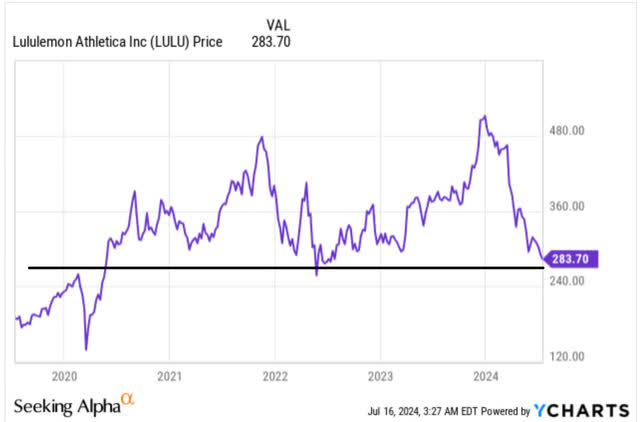

Reason #10: Major Support

Looking at Lululemon’s price chart, we can see that the $260 to $300 region (black line) has acted as a strong support level over the last few years, so from a technical standpoint, the stock could bounce here.

The stock could certainly fall lower, but the odds of the stock bottoming here are psychologically higher, than say, at $350 a share. If investors are looking for a bottom, this could be it.

Risks

While Lululemon stock looks like an attractive investment setup, we can’t totally dismiss the risks. In my view, there are three major risks:

- Manufacturing and Supplier Concentration: As of 2023, 42% of Lululemon’s products are manufactured in Vietnam and 40% of its fabrics are sourced from Taiwan. If geopolitical tensions or macroeconomic problems arise in said countries, Lululemon’s inventory — and thus, operations — could take a hit.

- Competition: This is nothing new — competition has been a bear argument for the better part of the last decade. While Lululemon has been successful in gaining market share, there may come a time when growth stops or declines as a result of fierce competition. Additionally, margins may deteriorate, reducing Lululemon’s earnings potential. However, I believe Lululemon has the brand moat that separates it from the rest, enabling it to sustain pricing power and profitable growth for the foreseeable future.

- Brand-only Moat: my biggest concern with Lululemon is that the success of the company solely relies on its brand moat. Lululemon doesn’t have a network effect moat — the company doesn’t become more valuable with each new customer added or new yoga pants sold. Lululemon doesn’t have a high switching cost moat — customers can turn to other activewear brands like On, Alo, or Gymshark. Lululemon doesn’t have a cost advantage moat — the company doesn’t own any production or manufacturing facilities. Lululemon doesn’t have an efficient scale moat — the activewear industry is characterized by many players with low barriers to entry. Put simply, if Lululemon’s brand tarnishes, so does the business.

Thesis

All things considered, I believe the risk-to-reward favors the bulls. After falling 40%+ from its all-time highs, Lululemon now trades at the same price it had four years ago, with valuation multiples sitting at a 10-year low.

I believe the slowdown in the US market was the main reason why the stock sold off so aggressively. But fear not, management remains optimistic in the US market as they work on optimizing their stores and restoring their inventory to recapture missed opportunities.

Aside from the slowdown in the US, I don’t see any other signs of fundamental weakness in the business. In fact, Lululemon is probably in the strongest position it has ever been in the history of the company. For instance, Gross Margin is trending higher, FCF is at record highs, and its international business is gaining steam.

With that being said, I’m overall bullish on Lululemon stock. As a summary, here are the 10 reasons why I think Lululemon is a great buy below $300 a share:

- Leading brand in premium athleisure and activewear.

- High Gross Margin with strong pricing power.

- Growth compounder over the last 20+ years.

- Massive runway in international markets and adjacent categories.

- Robust profitability profile with room for margin expansion.

- Record-high FCF with positive Net Cash position.

- Best-in-class ROIC in the sportswear industry.

- Excellent management and culture.

- Valuation at a 10-year low.

- The stock price is at a major technical support.

Catalysts include interest rate cuts, which could help improve consumer confidence and re-accelerate the US segment, as well as accelerated buybacks, which could boost EPS growth well above expectations.

In short, Lululemon is a best-of-breed company — but its share price clearly does not reflect that.

As such, I’m taking advantage of this disconnect.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.